A.I.R.E. registration

The A.I.R.E. (Registry of Italian Citizens Residing Abroad- Anagrafe degli Italiani Residenti all’Estero) contains the personal details of Italian citizens who live outside of Italy. The A.I.R.E allows the Italian government to hold your information so that, through the Italian consulate in the area where they reside, you can access the services and provisions that you are entitled to as an Italian citizen. These services include applying or renewing a passport, registering vital records (marriage, divorce, and children’s birth certificates), as well as obtaining ballot papers for Italian municipal and national elections. As an Italian citizen, it is your right and duty (under Law No. 470/1988, Article 6) to register with the A.I.R.E., and keep personal details, such as any change of address, up to date. If you are an Italian citizen and you intend to reside outside of Italy for more than 12 months, or if you have acquired Italian citizenship by descent in the U.S. or abroad via a consulate and your place of residence is not in Italy; then it is your responsibility to register with the A.I.R.E. within 90 days from the relocation date, or date you were recognized as an Italian citizenship. It is free to register with the A.I.R.E.

If you have applied for citizenship by descent through Jure Sanguinis or Jure Matrimonii outside of Italy, once your details have been recorded by a municipality or consulate you will be able to apply for an Italian passport. It is important to state that, from January 1, 2024, a new law (Law No. 213, Article 1, paragraph 242) came into effect that introduced a financial penalty for failure to register with the A.I.R.E. There is now in place a maximum penalty of €1,000.00 each year for failure to register with the A.I.R.E., which extends to 5 years, for Italian citizens (including minors) who live abroad.

Registering records

If you are an individual who had their citizenship recognized via an Italian consulate, your vital records will automatically be registered in the municipality in Italy which has the birth certificate of your Italian ancestor.

If you become an Italian citizen via applying in Italy at a municipality, once your citizenship has been recognized, your vital records will be automatically registered in that municipality.

In respect of future life events, such as birth of children, marriage or divorce, it is your responsibility as an Italian citizen who lives in Italy to inform the municipality, who will then will register the related records. Likewise, if, as an Italian citizen, you marry or divorce while living abroad, you will need to register those certificates. If you are an Italian citizen who lives outside of Italy, you will need to register vital records through the same consulate where you registered with the A.I.R.E, and the consulate will then automatically send the vital records to the municipality in Italy which has the birth certificate of the Italian ancestor. This will be done via the consulate’s vital statistic office, which is responsible for transferring such records to Italy. Birth, marriage, and death certificates in Italy are called atti di stato civile (civil record acts). They are located at the local anagrafe/stato civile (registrar’s office) in the town or city which was the location of the event or where you registered with the A.I.R.E. The consulate’s website, under the section Stato Civile (vital records), contains details about these forms. Finally, if you are an Italian citizen who resides abroad, it is your responsibility to register the birth certificates of any minor children you may have through the consulate, prior to their turning eighteen, in order for their Italian citizenship to be recognized.

If you obtain Italian citizenship via a 1948 case through an Italian court, once you have been granted citizenhip a copy of the decree granting you citizenship and related documents will be sent to the municipality where your ancestor was born and your vital records be registered. If you live outside of Italy, once the municipality registers the final decree and other documentation, they will also register you with the A.I.R.E, which will enable you to apply for a passport at your local Italian consulate.

For more information about 1948 cases and what happens after you win your case click here.

Codice Fiscale

The codice fiscale, or fiscal code/Italian tax code, is a unique alphanumeric identification number issued to individuals for tax and administrative purposes.

It is comprised based on the individual’s personal information, including their name, date of birth and gender. While it is not mandatory to request one, it is essential to have a codice fiscale for all matters relating to finances, such as opening a bank account, signing employment contracts, obtaining healthcare services, and filing tax returns.

Individuals who are born in Italy are automatically issued a codice fiscale; for individuals abroad it is issued by an Italian tax authority or consulate. With that said, the codice fiscale is not limited to Italian citizens and residents; it is also issued to non-residents for various purposes, including property transactions.

Please note that obtaining a tax code does not make you liable for income taxes in Italy. In fact, Italy taxes only Italian and non-Italian citizens who reside in Italy.

Tax obligations as an Italian citizen

In Italy, both residents and non-residents who have acquired income in Italy, or own assets within Italy, are obligated to pay tax. Tax liability is determined by the number of days spent in Italy. If you spend more than 183 days during a tax year in Italy; then your total income is subject to taxation. If you spend less than 183 days in Italy during a tax year, you will be taxed ONLY on the total income generated in Italy during that period.

According to Article 2 of the Italian tax code, an individual is considered an Italian resident for tax purposes if: the person is physically present on Italian territory for more than 183 days, the individual has a registered “residence” in Italy. If these criteria are NOT met, the person is NOT deemed a tax resident and is NOT eligible to pay taxes. The fiscal year runs from January to December, and Italian residents will be subject to taxation for that period. If you are an Italian citizen who relocates abroad, you would be required to remove yourself from the Records of the Italian Resident Population, and you would also be responsible for registering with the A.I.R.E.

If you are considered to be tax resident, in order to avoiding double taxation, Italy and other countries, the U.S. being one, have special agreements in place known as double tax treaties (DTTs), which ensure an Italian citizen who resides outside of Italy pays only the tax they are obligated to.

For more information on tax responsibilities for Italian citizens see our related article here.

Voting in elections

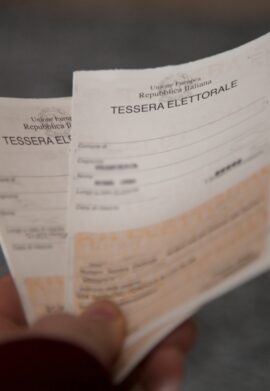

In Italy there exists is no legal obligation to vote, but Article 48 of the Italian Constitution cites voting as an “exercise is a civic duty”. Being eligible to vote in the European elections in Italy requires that you are 18 years old, an Italian or an EU citizen with a legal residence in Italy, or an Italian citizen residing abroad, or you are registered as a voter (for EU citizen voting in Italy). If you are an Italian or EU citizen voting in Italy, you can vote at the polling station where you are registered. This will be stated on your electoral card.

If you are an Italian citizen voting from another EU country, or you have residence in another EU Member State and are registered with A.I.R.E., you may vote at the polling stations at the the Italian diplomatic-consular offices of the country in which you live.

if you are an Italian citizen who lives permanently or temporarily in another EU country, for work or study reasons, you can go to the designated polling stations established by the diplomatic and consular network. If you are an Italian citizen voting from a country outside the EU, and registered with A.I.R.E., you may exercise your right to vote abroad in your place of residence for national elections by receiving the ballot papers and instructions on how to vote via mail from the relevant consular office.

This segment has been written to provide you with essential information regarding responsibilities as an Italian citizen.

If you would like more information on Italian citizenship, you can contact us directly and one of our friendly experts will be in touch to respond to your questions.